nj bait tax explained

January 18 2022 Update. Therefore when you make the BAIT election the NJ business owners individual tax return applies a 100 credit for the business taxes paid against their NJ income taxes to avoid.

New Jersey Pass Through Business Alternative Income Tax New Jersey Mercadien

The PTEs distributive income is subject to tax at the following graduated rates for purposes of computing the BAIT.

. The New Jersey pass-through entity tax took effect Jan. For the 2020 tax year the four tiers of income tax rates are as follows. Ad See If You Qualify For IRS Fresh Start Program.

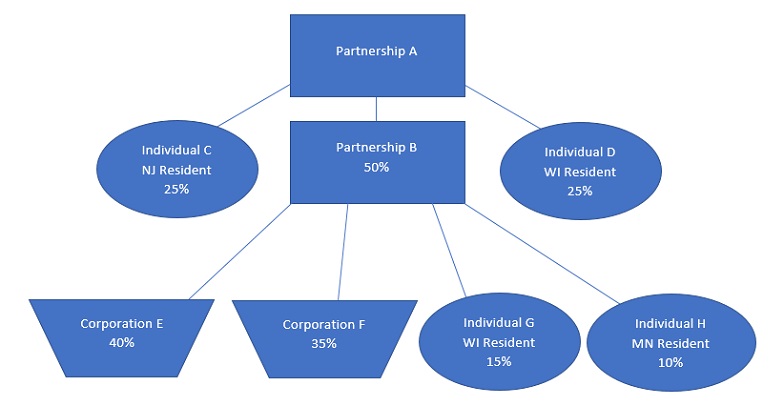

The BAIT program is intended to give New Jersey individual income taxpayers a work-around of the 10000 annual limitation on the deductibility of state taxes imposed by the. Amount over 250000 but not over 1 million 1418750 plus 652 of excess over 250000 652. As a result the NJ BAIT Tax Base for resident and nonresident shareholders will be based on their pro-rata share of their NJ source income.

Individuals estates and trusts receive a credit against their gross income tax equal to the members tax on the share of distributive proceeds paid by the pass-through entity. The tax is calculated on every members share of distributive proceeds including tax. 5675 for distributive proceeds below 250000.

The NJ BAIT program is estimated to save business owners 100 to 500 million annually. The revised version of the NJ BAIT will utilize the New Jersey source income rather. This new law allows pass-through businesses to pay income taxes at the entity level instead of the personal level.

1 2020 and provides PTEs the opportunity to alleviate the effects of the SALT limitation. The highest tax bracket now kicks in at 1000000 to be more in line with individual tax rates. In January 2022 NJ Governor Murphy signed a bipartisan bill S4068 that modifies the BAIT structure and cleans up aspects of the original tax that did not.

1418750 plus 652 for distributive proceeds between 250000 and 1000000. As the New Jersey Division of Taxation rolled out its interpretation and guidance of the Business Alternative Income Tax BAIT serious concerns surfaced. Were going to take a deduction for the New Jersey BAIT paid in 1581750 resulting in 25918250 a federal income and allocated the three ways 8639417.

For S-corporations BAIT is calculated on NJ source income from the K-1. Now if we apply. The New Jersey BAIT was designed as a work-around to the 10000 federal limit on the deduction of state and local taxes enacted in the Tax Cuts and Jobs Act of 2017.

We Help Taxpayers Get Relief From IRS Back Taxes. 400000 50 of 800K 388000 50 of 800K less 24K of NJ BAIT deducted at entity level Federal Income Tax. NJ BAIT Apportionment Factor For.

The tax rates for NJ BAIT range from 5675 to as high as 109 on New Jersey sourced income. The pass-through income tax or BAIT applies to tax years beginning on Jan. Pass-Through Business Alternative Income Tax PTEBAIT For New Jersey tax purposes income and losses of a pass-through entity are passed through to its members.

Beginning in 2022. Free Case Review Begin Online. Amount over 1 million but not over 5 million.

With NJ BAIT. To rectify the implementation issues with New Jerseys Business Alternative Income Tax BAIT a clean-up bill was drafted which has been signed by. 140000 400K x 35.

Nj Division Of Taxation 2018 Income Tax Changes

Dor Pass Through Entity Level Tax Partnership Determining Income And Computing Tax

New Jersey Businesses Should Consider Salt Deduction Limitation Withum

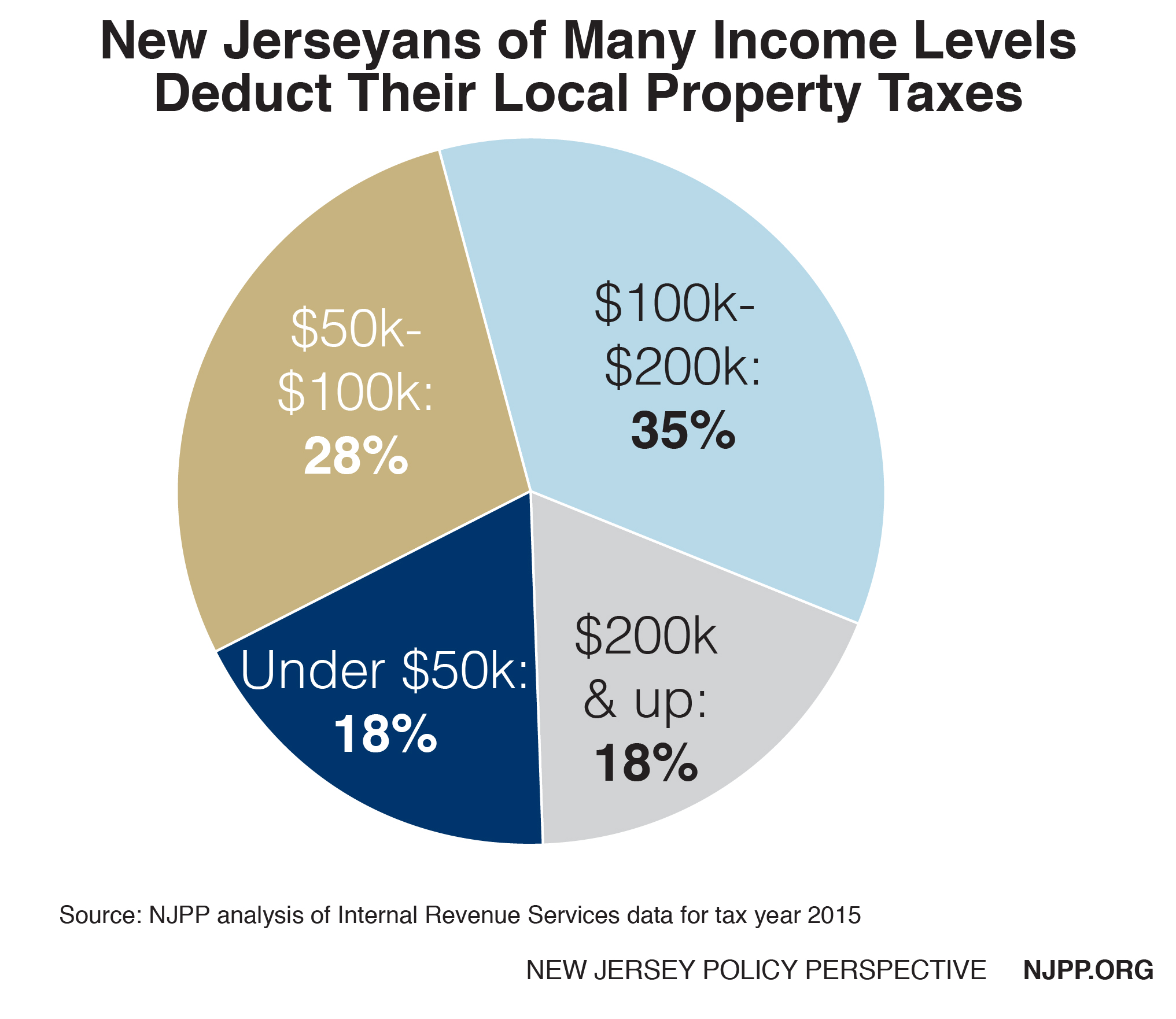

Millions Of New Jerseyans Deduct Billions In State And Local Taxes Each Year New Jersey Policy Perspective

New Jersey Pass Through Business Alternative Income Tax Bait Updates Marcum Llp Accountants And Advisors

Covid 19 Montville Township Nj

Nj Business Alternative Income Tax Bait By Michael Brown Cpa Prager Metis

New Jersey Businesses Should Consider Salt Deduction Limitation Withum

New Jersey Businesses Should Consider Salt Deduction Limitation Withum

Livingston Accountant Addresses New Jersey Business Alternative Income Tax Livingston Nj News Tapinto

Nj Division Of Taxation Nj 1040 And Nj 1041 E File Mandate Faq

Nj Pass Through Businesses Taxed At Entity Level In 2020

2018 Tax Total Tax Table Moorestown Township Nj Official Website

Business Activity Code For Taxes Fundsnet

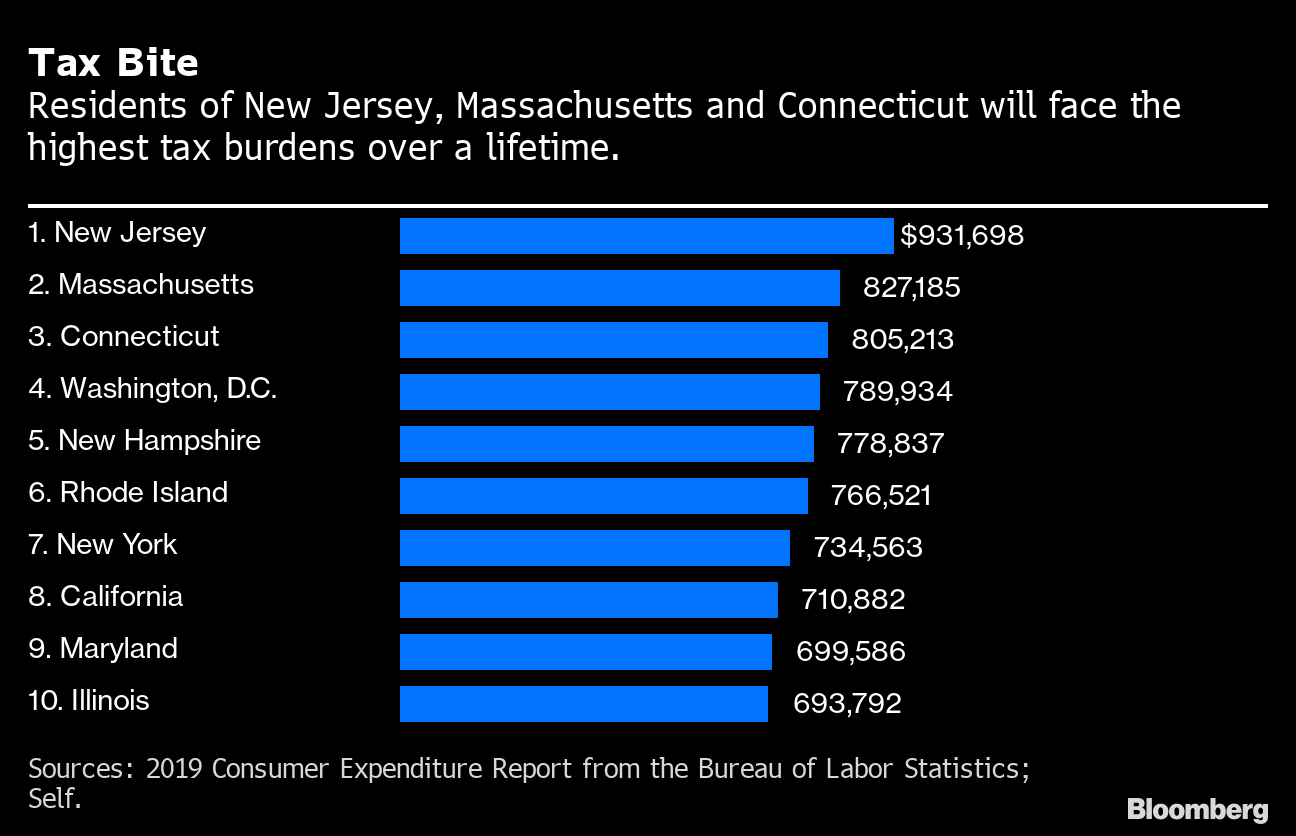

New Jersey Residents Will Pay Most In Taxes Over A Lifetime Bloomberg

Used 2016 Chevrolet Suburban For Sale In Jersey City Nj Edmunds

Itemized Deductions Nj Property Tax Deduction Credit Ppt Download